Interac® Online Processing

Overview

Interac Online is an easy-to-use online payment method that allows users to pay for their purchases directly from a bank account. Its only requirement is access to online banking through a participating financial institution. Payments made with Interac Online are conducted through the convenience of the existing online banking access, without a need for any new user names, passwords or accounts. This payment method can integrate seamlessly into a webstore's checkout process.

Interac Online is an offering of Interac Association, which is a recognized world leader in debit card services.

The typical Interac Online payment processing flow gos through the following steps:

- The online merchant’s checkout page redirects the user to the Interac Online gateway page, which prompts the user to select the financial institution with their payment account.

- The user logs in to online banking and selects the account to pay from. The user is prompted to confirm the payment amount.

- After confirmation of the payment through the user's financial institution’s secure online banking, the user is returned to the merchant’s checkout confirmation page, and the user's order is processed.

The current integration supports both Authorization and Refunds.

Merchant Onboarding Process

To begin using Interac Online in your webstore, work with Radial to complete the following steps:

-

The merchant asks Radial to enable Interac Online on their webstores. Radial creates a merchant account to get started.

-

The merchant provides Radial with a Referrer URL. This is the Merchant's URL from which a user would initiatie the interac online request.

-

The merchant should configure funded and non-funded URLs to validate that the request is coming from the merchant and being redirected back to the merchant correctly.

Interac® Online Transaction Authorization

Interac® Online Authorization is initiated from the webstore and involves four major steps:

-

The merchants initiates a transaction request (InteracOnlineTransactionRequest) with the order data and billing data.

-

Radial's response contain the HTML form that the merchant displays on the checkout page. The HTML form contains the list of financial institutions available for the user to choose from to perform a debit transaction on the selected bank account.

-

The user selects the bank, logs in, selects the account, and initiates a debit transaction. If the transaction is successful, the user is redirected to the merchant's funded URL, typically the order confirmation page. In case of any error, the HTML displays a corresponding notification for the user to retry the transaction.

-

After the order is confirmed, the merchant makes a Transaction Auth Request (InteracOnlineTransactionAuthRequest), with all the data from the Bank response, to capture the Auth transaction.

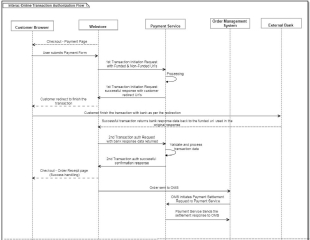

Interac® Online Transaction Authorization Flow

Happy-path scenario

-

The customer submits the request from the payment checkout page.

-

The webstore sends the Transaction Request to Radial's payment service along with funded and non-funded URLs.

-

The payment service (after basic validations), responds with redirect HTML URL. The HTML is passed back to the webstore as part of the response message.

-

The response includes a value for InteracOnlineOrderId (which is used by Payments Service to link both requests of Auth transaction).

-

The webstore redirects the customer to the redirect HTML URL in the response.

-

After the customer finishes the transaction successfully, flow is re-directed to the funded URL mentioned in the original request.

-

The webstore then initiates Transaction Auth Request and passes bank response fields returned as part of funded URL along with the InteracOnlineOrderId value sent back in the original response.

-

The payment service validates and processes the Transaction Auth Request and sends a response to the webstore.

-

The webstore redirects the customer to the receipt page, upon successful transaction.

-

The webstore sends the order to the order management system for shipment and settlement process.

-

The order management system sends the Payment Settlement Request to payment service when the order is ready for shipment.

-

Payment service sends the Settlement response to the order management system. The order management system acts appropriately based on the status of the Settlement response.

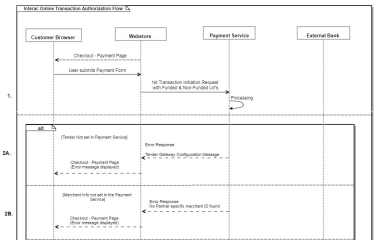

Error scenarios

-

Flow 1:The customer submits the request from payment checkout page. The webstore sends the Transaction Request to the payment service along with funded and non-funded URLs. Payment service perform basic validations and responds to webstore with appropriate response.

-

Flow 2A: Error response is sent out if Tender is not configured for a specific partner within payment service for Interac Online transaction calls.

-

Flow 2B: Error response is sent out for Interac Online transaction calls, if Merchant data is not configured within payment service for a specific partner.

-

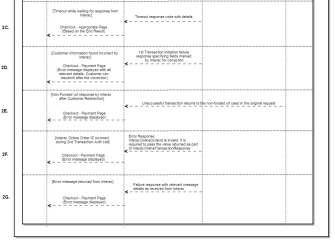

Flow 2C: Timeout response code is sent out in reply for Interac Online transaction calls, after the defined time frame. Transaction is marked as Timeout in payment service. The Payment Service will attempt to retry the authorization for a configured amount of attempts, and the webstore can call ConfirmFunds to check the status of the retries. A confirm funds response of Timeout will mean the authorization is still being attempted, whereas a status of Success or Fail will represent the status of a successful retry.

-

Flow 2D: Fail response code is sent out in reply for Interac Online transaction request along with ErrorDetail. It can also have a specific ErrorMessage that can be displayed to the customer and ErrorFields list specifying problem fields identified.

-

Flow 2E: If there is any issue for customer to finish the transaction to the redirected html URL after Interac Online transaction call, webstore is called on non-funded URL indicating issue with further continuation.

-

Flow 2F: The payment service relates the original Interac Online transaction during Auth call using InteracOnlineOrderId. If it is not able to find the original request, then an error response will be sent out.

-

Flow 2G: Fail response code is sent out in reply for Interac Online transaction calls along with ErrorDetail, and it might also have a specific ErrorMessage that can be displayed to the customer.

Interac Online API Operations

Interac® Online processing uses the following API operations: